Despite the challenges, by outfitting traditional warehouses with upgraded features to support temperature-controlled space, speculative development is becoming an advantageous way for investors to capitalize on the rapidly growing demand for cold storage facilities.

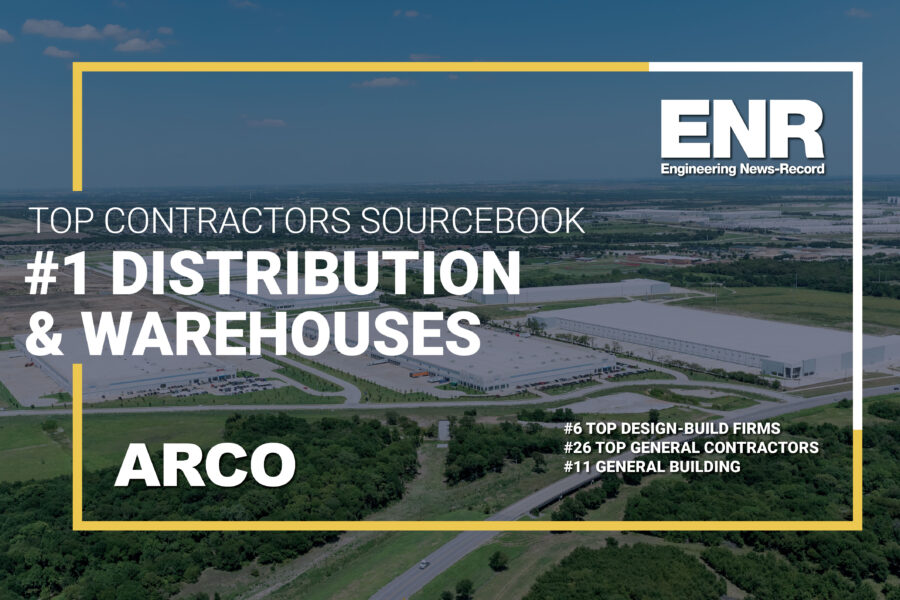

After nearly two years since the onset of the Covid-19 pandemic, global supply chain disruptions continue to create challenges traditional contractors may have difficulty addressing. Prices remain above historical averages and material procurement issues are continuing, especially for key commodities such as structural steel, roofing, and precast concrete. However, the construction industry, especially industrial development, continues to see significant growth as investors remain aggressive and contractors, like ARCO, are finding ways to mitigate risk for building owners and investors.

ARCO’s design-build process and expert proposal delivery, combined with our significant national presence and buying power, allows for pricing to be locked in and key materials to be secured immediately upon execution of a letter of authorization, mitigating risk and saving valuable schedule time.